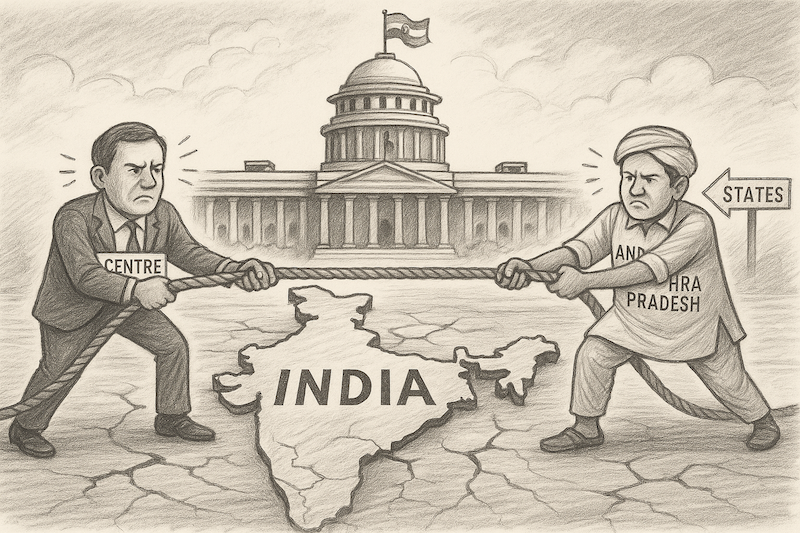

A System Under Stress: Centre-State Fiscal Imbalance

The Centre and States share the revenue collected under India's federal structure. Constitutionally, taxes collected by the Centre—like income tax and union excise duties—are distributed based on the recommendations of the Finance Commission under Article 280. While the 15th Finance Commission fixed the States’ share at 41%, in reality, their effective share has declined due to the rising reliance of the Union on non-divisible cesses and surcharges.

Between FY2015-20 and FY2020-24, the share of cesses and surcharges in the Centre’s gross tax revenues increased from 12.8% to 18.5%.

This has significantly eroded States’ actual share in the total tax kitty, reducing it from an average of 35% to just about 31%—despite a constitutional mandate for equitable sharing.

Post-GST Realities: Limited Revenue Levers for States

The introduction of the Goods and Services Tax (GST) in 2017, while a significant step toward tax harmonisation, has narrowed States’ autonomy in mobilising revenue. With the merger of several indirect taxes into GST and limited scope to levy new taxes, States are heavily dependent on GST compensation and central transfers. Although GST collections have improved post-COVID, States still face volatility in receipts and lack the flexibility to pursue region-specific fiscal strategies.

States now raise around 40% of their own revenue, compared to nearly 55% in the pre-GST era.

This dependency amplifies the urgency of equitable vertical devolution—that is, how much of the Centre’s net tax revenue is shared with all States.

Demands of the States: A Push for 50% Share

The call for a larger share in the divisible pool is being raised not just by opposition-ruled States but also many BJP-ruled States. Their demand for raising the devolution to 50% reflects both fiscal necessity and the growing realization that current allocations are misaligned with economic responsibilities devolved to States, particularly in health, education, rural development, and infrastructure.

States argue that constitutional decentralisation of functions has not been matched by fiscal decentralisation, leading to a mismatch between expectations and resources.

Horizontal Devolution: Penalizing Performance?

The horizontal distribution formula—how the total devolution is split across States—uses criteria such as population, income distance, forest cover, demographic performance, and tax effort. However, States in South India and other better-performing regions contend that the formula penalizes their progress:

-

Population weight (based on 2011 Census) hurts those States that have managed to control population growth.

-

Income distance favours poorer States, ignoring fiscal effort and good governance.

There is a growing sentiment that horizontal devolution should reward efficiency, sustainability, and innovation, rather than just need and backwardness.

What’s at Stake: Cooperative Federalism vs Fiscal Centralism

The Centre’s increasing fiscal dominance through cesses and surcharges—neither recommended by the Finance Commission nor shareable—undermines transparency and accountability in federal finance.

This trend violates the principle of cooperative federalism and veers toward a more centralised fiscal regime.

Retaining the 41% vertical share without reforming cesses and surcharges will perpetuate fiscal asymmetry. It will also strain Centre-State relations at a time when State capacity is crucial for implementing national goals—whether it's climate resilience, infrastructure development, or social protection.

The Way Forward: Reimagining India’s Fiscal Compact

To ensure a fair and sustainable fiscal relationship, the 16th Finance Commission must:

-

Increase the vertical share modestly—perhaps to 45%—to signal intent while maintaining fiscal prudence.

-

Cap cesses and surcharges at a fixed percentage of gross tax revenue and recommend their inclusion in the divisible pool once thresholds are crossed.

-

Recalibrate horizontal devolution to balance equity with performance by factoring in:

-

Fiscal discipline

-

Tax effort

-

Demographic control

-

SDG outcomes

-

-

Create a formal mechanism to audit and regulate the Centre’s use of non-divisible levies.

-

Establish a standing intergovernmental fiscal council to mediate disputes and promote transparency.